How to Rent Your House and Then Buy Another [house hacking 2.0]

If you’re like many people, you may be working more from home and thinking about moving into a larger house with more space, maybe even in a smaller town where prices are more affordable. But what do you do with the home you have now?

Sell it, of course! The housing market is high and you need that money for your next down payment. But have you ever considered renting out your house and managing it, instead of selling it? It’s a great way to get your first rental as an investor.

More homeowners these days are choosing to enter the real estate investment business by turning their current home into a rental and buying a different primary residence. This way, they’re able to take advantage of the many benefits that rental property owners enjoy.

Sound interesting? Then keep reading to learn how to rent your house and buy another and potentially generate some well-earned extra income.

Why Renting Can be Better Than Selling

In the real estate business, “house hacking” is a process used to get other people to pay all or part of your mortgage. The good news is that almost anyone can hack their current home by renting it out to buy another, and you don’t have to be an experienced real estate investor to get started.

There are several benefits to renting your home and then buying a second home:

Generate recurring income

U.S. rental prices have reached their highest point in two years, and it’s likely that rents will continue to rise. There’s more demand for rental property than there is supply, and as home prices continue to climb a growing number of people are opting to rent rather than own, which in turn creates even more demand for good homes to rent.

As long as the amount you receive in rent each month from a good tenant pays for your repairs, expenses, and mortgage it could make more financial sense to rent to somebody else rather than sell.

Defer capital expenditures

When you sell a home it’s possible a buyer will ask for a number of things to be fixed, such as an ageing central heating and cooling system or replacing an older roof. Items like these can easily run $10,000 or more and reduce the profit you make when you sell a home.

Tenants on the other hand are not nearly as demanding. Yes, you may still need to make a major repair at some point, but you can do it on your own terms instead of the buyer’s.

By deferring these major costs by renting your house, you’ll also have more time to save up money from the rent you collect and take care of major maintenance items over time.

Benefit from real estate investing tax breaks

Tax law in the U.S. is extremely friendly to real estate investors. In fact, the tax breaks of owning real estate are one reason why many investors pay very little in taxes while having plenty of cash in the bank.

When you turn your primary residence into a rental, items such as maintenance and repairs, insurance and property tax, and mortgage interest and property management fees are fully tax-deductible from the rental income you receive.

Depreciation expense is another significant tax benefit of owning rental property. According to IRS Publication 527, residential rental property depreciates or wears out over 27.5 years. That means if the value of your home (excluding the land) is $200,000 you’ll be able to reduce your taxable net income by $7,273 per year ($200,000 / 27.5 years) until your depreciation expense runs out or until you sell the home.

How to Finance a Second Home

To be sure, one of the reasons most people sell their current home to buy another is because they need a down payment. But with the way real estate prices have been rising over the last 10 years, you may have a significant amount of equity tied up in your current home just waiting to be put to better use.

As Zillow reports, typical home values in the U.S. have increased by nearly 79% over the past decade, and are forecast to grow by another 15% this year alone. For someone who purchased their home 10 years ago for $165,000, accrued equity could be nearly $130,000 (based on a typical middle price tier home).

Down payment

Most lenders will ask for a down payment of 20% when you finance a second home. That’s because banks view borrowers with two mortgages as being a little riskier than people with just one home loan. However, a bigger down payment can work in your favor because interest rates and terms will generally be more favorable, which means your monthly mortgage payment will be lower.

Refinancing

A second option for financing a second home is to refinance the first one. By doing a cash-out refinance you can turn accrued equity into cash, then use that money to make the down payment on the second home. This is tax-free money you can pull out of your primary residence, even if you’re turning it into a rental.

If you consider refinancing, be sure to research conventional loans backed by Fannie Mae and Freddie Mac. Conventional mortgages often offer more flexible terms, especially for borrowers with higher credit scores and larger down payments.

Home equity line of credit

Another good way to finance a second home is to apply for a home equity line of credit (HELOC) on your current home. Rather than receiving your equity in one lump sum by refinancing, a HELOC lets you draw on your home’s equity at your convenience and in the amount that you want, up to certain limitations set by the lender.

HELOC repayments are made monthly, similar to the way a credit card works, and the credit line can usually be reused multiple times.

Understanding Rental Income and Expenses

Before you actually rent your house and buy a second home, crunch the numbers to make sure that renting out our first place will be profitable. You can put together a pro forma cash flow statement that projects your potential rental income and expenses:

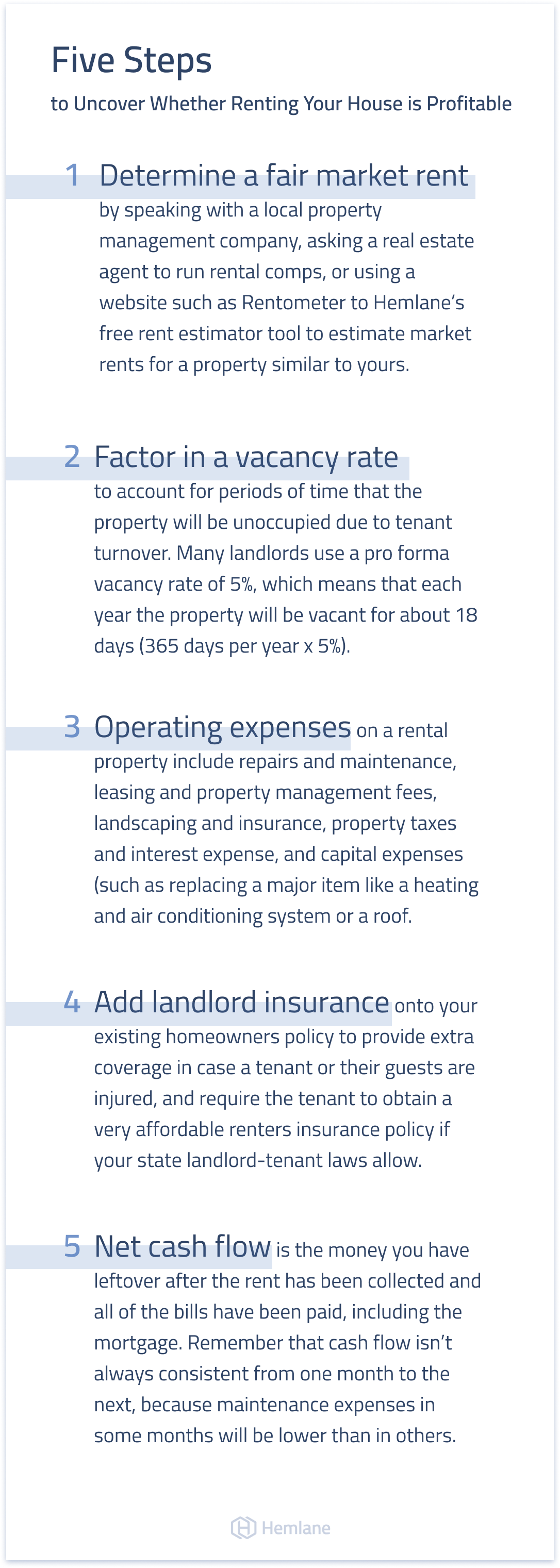

1. Determine a fair market rent by speaking with a local property management company, asking a real estate agent to run rental comps, or using Hemlane’s free rent estimator tool to estimate market rents for a property similar to yours.

2. Factor in a vacancy rate to account for periods of time that the property will be unoccupied due to tenant turnover. Many landlords use a pro forma vacancy rate of 5%, which means that each year the property will be vacant for about 18 days (365 days per year x 5%).

3. Operating expenses on a rental property include repairs and maintenance, leasing and property management fees, landscaping and insurance, property taxes and interest expense, and capital expenses (such as replacing a major item like a heating and air conditioning system or a roof.

4. Add landlord insurance onto your existing homeowners policy to provide extra coverage in case a tenant or their guests are injured, and require the tenant to obtain a very affordable renters insurance policy if your state landlord-tenant laws allow.

5. Net cash flow is the money you have leftover after the rent has been collected and all of the bills have been paid, including the mortgage. Remember that cash flow isn’t always consistent from one month to the next, because maintenance expenses in some months will be lower than in others.

How to Rent Your House: Step-by-step

Here are the steps to follow when you’ve decided that you’d like to rent out your primary house.

- Speak with an experienced mortgage broker to understand your capital requirements.

- Find your new home.

- Time your closing date with the move-in date for your new rental home.

- Advertise your first home on rental listing websites, using market rents.

- Find and select the best tenant.

- Ensure you have your new insurance lined up for the move-in date.

- Set up your property management processes and systems to get ready for the new tenant.

Final Thoughts

Renting your house to buy a second home can be a good financial move for many people. The demand for good rental property in nearly every market across the country is strong, while both rents and property values keep rising.

Generating passive recurring income from tenant rents, deferring making major repairs until the time is right, and the major tax breaks that real estate investors enjoy are three of the many benefits of turning your home into a rental and buying another.